National Cinema Day, celebrated on September 3rd, saw 30,000 screens participating to celebrate the theatrical experience (1). Have you considered how the silver screen might offer valuable financial lessons? From budgeting wizards to investment gurus, cinema has given us characters whose financial acumen rivals that of Wall Street’s finest. Let’s explore how these fictional figures can provide real-world financial insights for us.

1. Marty Byrde (Ozark)

While we can’t condone Marty’s illegal activities, his financial skills are undeniable. Byrde’s ability to launder money showcases a deep understanding of complex financial systems. His strategies for moving funds through various businesses demonstrate:

- Diversification of assets

- Understanding of cash flow management

- Ability to identify undervalued businesses

These skills, when applied ethically, are crucial for effective financial planning and investment strategies.

2. Miranda Priestly (The Devil Wears Prada)

As the editor-in-chief of Runway magazine, Miranda Priestly exemplifies financial savvy in the corporate world. Her character highlights:

- The importance of understanding your industry’s economic landscape

- How to leverage professional networks for financial gain

- The value of maintaining a strong personal brand

Priestly’s ability to make tough decisions that benefit her company’s bottom line, while maintaining its prestige, is a lesson in balancing short-term costs with long-term value.

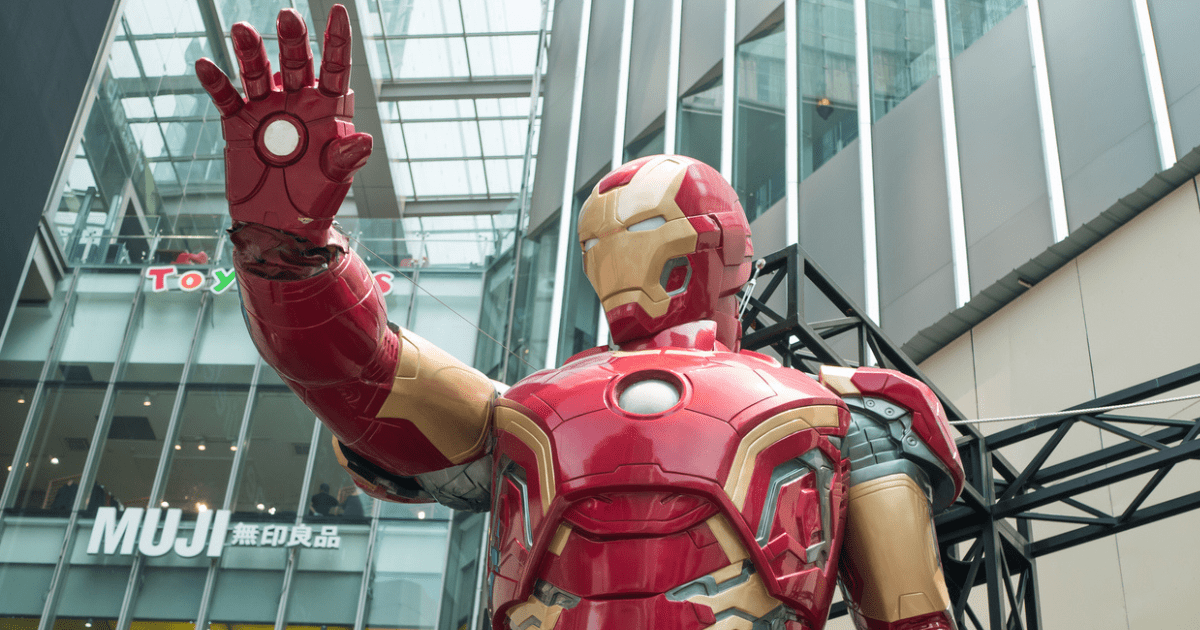

3. Tony Stark (Iron Man)

Beyond his superhero persona, Tony Stark is a brilliant industrialist and investor. His character demonstrates:

- The power of investing in research and development

- How to pivot a company’s focus to meet changing market demands

- The importance of intellectual property in building wealth

Stark’s transition from weapons manufacturing to clean energy showcases the financial benefits of adapting to societal changes and ethical considerations.

4. Bruce Wayne (Batman Series)

Bruce Wayne may be known as Batman, but his financial acumen, particularly regarding estate planning, is noteworthy. His character highlights:

- The importance of creating a robust estate plan to manage wealth

- Preparing for future uncertainties through careful financial planning

- Ensuring the protection and growth of assets for future generations

Bruce’s approach to estate planning demonstrates the significance of having a well-thought-out financial strategy, ensuring his legacy and the well-being of his beneficiaries.

5. Forrest Gump (Forrest Gump)

Though Forrest may come across as simple-minded, he exhibits wise financial habits, particularly in saving for his future:

- Consistent saving habits through his shrimp business and investments

- Understanding the importance of staying financially prepared

- Highlighting the benefits of long-term financial planning for retirement

Forrest’s disciplined approach towards saving and investing ensures his financial stability, demonstrating that long-term planning is key to a secure retirement.

Inspired by Your Favorite Characters

As we’ve seen, financial wisdom can be found in the most unexpected cinematic places. From Marty Byrde’s complex financial maneuvers to Bruce Wayne’s estate planning, these characters offer unique perspectives on money management. How might these fictional examples inspire real-world financial strategies? Could drawing parallels between beloved movie characters and sound financial principles make our discussions more engaging and relatable?

Interested in exploring more creative approaches to financial planning? Let’s continue this conversation and discover how we can work together to bring financial concepts to life for your clients. Schedule a complimentary meeting today to discuss this further.

Sources

(1) McClintock, Pamela. “Movie Theaters Offering $4 Tickets on Aug. 27 for Second Annual National Cinema Day.” The Hollywood Reporter, 23 Aug. 2023, www.hollywoodreporter.com/movies/movie-news/movie-theaters-4-dollar-tickets-august-27-1235571034/

Diversification does not guarantee profit nor is it guaranteed to protect assets. Investing involves risk, including possible loss of principal. No investment strategy can ensure financial success or protect against losses. This information is being provided only as a general source of information and is not intended to be the primary basis for investment decisions. It should not be construed as advice designed to meet the particular needs of an individual situation. Please seek the guidance of a financial professional regarding your particular financial concerns. Consult with your tax advisor or attorney regarding specific tax issues. Our firm does not offer tax, legal, or estate planning advice or services. Always consult with your own tax and legal advisors.